Live Feed

Today, February 10, 2026

04:45

Whale Alert reported that 3,500 million USDT has been burned at the Tether Treasury.

04:31

South Korean crypto exchange Upbit announced that it has designated Dent (DENT) for its delisting watchlist. Upbit explained that the decision was made after a comprehensive review based on best practices for supporting virtual assets. The exchange cited numerous shortcomings in areas such as the disclosure of important information, the transparency and rationality of its change procedures, the asset's utility, and the viability and sustainability of its related business. Due to these issues, Upbit determined there is a potential for harm to users.

04:04

Binance has announced the listing of the PAXG/USD1 cross margin trading pair, scheduled for 8:30 a.m. UTC today. Additionally, the ASTER/U, SUI/U, and XRP/U cross margin pairs will be listed at 10:30 a.m. UTC.

03:56

The Bitcoin Coinbase Premium, which measures the price difference between Coinbase and the global market average, has shown signs of recovery alongside a price rebound, but it is too early to consider this a broader trend reversal, CoinDesk reported. The premium has risen from a low of -0.22% to -0.05%. While this signals an influx of dip-buying, the premium remains in negative territory, suggesting a full-scale bullish reversal has not yet begun. Citing data from Kaiko, the report noted that aggregate trading volume on major exchanges is still significantly below its peak from late last year, indicating that demand has not yet clearly recovered. Although BTC has bounced more than 15% from its recent low, it remains down over 10% on a weekly basis. The analysis concluded that without additional buying pressure, the price could fall again.

03:29

U.S. fintech companies are at odds with traditional banks over expanded access to the Federal Reserve's payment network, Decrypt reported. The Fed previously announced it was seeking public comment on a proposal to introduce payment accounts—a streamlined version of master accounts—that would grant access to the central bank's payment network without complex requirements. While fintech firms highlight the potential for innovation and cost savings through direct payments, banks argue the move could allow stablecoin issuers and crypto-related companies to indirectly access the Fed's core infrastructure. They warn this could undermine the stability of the financial system and create regulatory blind spots. The outlet noted that the Fed's decision is expected to reshape the U.S. financial ecosystem.

03:03

Binance has announced it will delist 10 cross margin and 10 isolated margin trading pairs at 6:00 a.m. UTC on Feb. 13. The affected pairs for both categories are QNT/BTC, GRT/BTC, CFX/BTC, IOTA/BTC, ROSE/BTC, THETA/BTC, SAND/BTC, RUNE/BTC, ALGO/BTC, and LPT/BTC.

03:02

The following shows estimated liquidation volumes and position ratios for major crypto perpetual futures over the past 24 hours:

- BTC: $121.58 million liquidated (55.3% longs)

- ETH: $76.42 million liquidated (55.7% shorts)

- SOL: $15.45 million liquidated (58.22% longs)

02:26

South Korean prosecutors have appealed a court ruling that found it impossible to accurately calculate the illicit gains in the first case prosecuted under the country's Virtual Asset User Protection Act, Newsis reported.

The defendants in the case are accused of securing illicit profits worth 7.1 billion won (around $5.1 million) by manipulating the price of a cryptocurrency, referred to as A Coin, between July and October 2024. They allegedly inflated trading volume and used wash trading to lure buyers.

In the initial trial, the court did not accept the prosecution's claimed illicit gains of over 7.14 billion won, deeming the amount unquantifiable and thus partially acquitting the defendants. Prosecutors are now arguing that the lower court's decision was based on a misunderstanding of the law, a misinterpretation of the facts, and an inappropriate sentence.

02:17

An address linked to the Astra Nova (RVV) team transferred 5.354 billion RVV, worth $6.6 million, over a four-day period following Binance's announcement that it would delist the RVV/USDT perpetual futures contract, according to EmberCN. The transferred amount represents 53.54% of the total RVV supply. Of this total, 354 million RVV ($607,000) was deposited into exchanges including Bitget, KuCoin, and MEXC. EmberCN noted that while the remaining five billion RVV ($5.97 million) has not yet been sent to exchanges, the addresses that received the tokens have a history of making such deposits, suggesting more could follow. The price of RVV has dropped by approximately 59% since the delisting was announced.

02:08

South Korea's Democratic Party has formalized its plan to push for the decentralization of virtual asset exchange governance, Digital Asset reported. At a parliamentary countermeasures meeting on Feb. 10, Han Jeong-ae, the party's policy committee chairperson, said the party would swiftly advance a digital asset basic act to improve structural problems at exchanges and build a trustworthy trading foundation. She stated the legislation would address systemic weaknesses by mandating internal control standards, requiring periodic external audits of exchanges' digital asset holdings, implementing no-fault liability for service providers in case of system failures, and introducing suitability reviews for major shareholders. Regarding a recent incident where Bithumb mistakenly sent excess Bitcoin to a user, Han commented that it was more than a simple operational error and exposed vulnerabilities in the exchange's ledger and internal control systems. She added that the event confirmed that even the country's top three firms have weaknesses in their verification systems, multi-confirmation procedures, and human error controls.

02:02

Bitmine withdrew 20,000 ETH, worth $42.3 million, from BitGo seven hours ago, Lookonchain reported. The firm had previously withdrawn another 20,000 ETH from FalconX.

02:01

South Korean crypto exchange Bithumb has announced that it will temporarily suspend deposits and withdrawals for Inisia (INIT) starting at 2:00 a.m. UTC on Feb. 17 to support a network upgrade.

01:31

Danal affiliate Danal Fintech has signed a memorandum of understanding (MOU) with Sahara AI, a decentralized artificial intelligence and blockchain platform, for strategic cooperation in the stablecoin, payments, and finance sectors, Etoday reported. Danal Fintech will provide its payment and settlement infrastructure and Sahara AI its AI technology capabilities to advance next-generation digital financial services, such as integrating payment services into AI agents.

01:28

While the extreme fear gripping the market could be interpreted as a bottom signal, bearish trends in the futures market and key technical indicators suggest the possibility of a further decline, Cointelegraph reported, citing multiple analysts. Crypto trader Michaël van de Poppe noted that the Bitcoin Fear & Greed Index fell to an all-time low of five over the weekend, and the daily Relative Strength Index (RSI) for BTC dropped to 15, entering an extreme oversold zone. He diagnosed these levels as similar to those seen during the 2018 bear market and the March 2020 COVID-19 crash. Meanwhile, CryptoQuant analyzed that BTC is currently trading below both its 50-day moving average (around $87,000) and its 200-day moving average (around $102,000). The firm added that the Z-score comparing BTC and gold prices is at -1.6, indicating that selling pressure continues to dominate.

00:53

A claim by CNBC's "Mad Money" host Jim Cramer that the U.S. government would buy Bitcoin at the $60,000 level is a rumor with no legal basis, CoinDesk reported. Cramer had previously stated on CNBC that if BTC were to fall to $60,000, the government would begin to fill its reserves.

However, the outlet noted that there is currently no federal mechanism for purchasing cryptocurrency in large quantities. Establishing such a reserve would require congressional legislation, but the proposed crypto market structure bill (CLARITY Act) does not contain any such provisions. Treasury Secretary Scott Bessent has also affirmed that he lacks the authority to orchestrate a BTC bailout.

The federal government's current BTC holdings, estimated to be worth around $23 billion, are the result of seizures from criminal investigations, not new purchases. Meanwhile, state governments are moving more quickly, with several having pursued legislation last year to permit BTC reserves and allocate portions of their budgets to cryptocurrency.

00:26

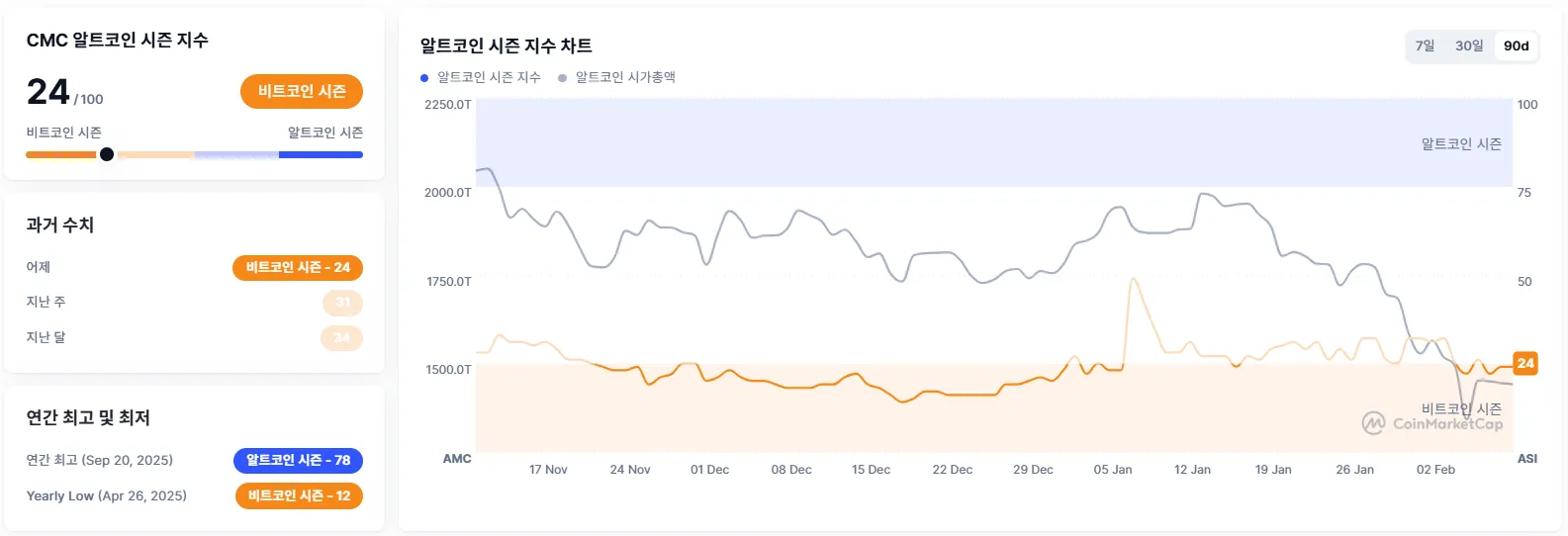

CoinMarketCap's Altcoin Season Index is currently at 24, unchanged from yesterday. The index determines whether it is an "altcoin season" by comparing the performance of the top 100 cryptocurrencies by market cap, excluding stablecoins and wrapped coins, against Bitcoin. An altcoin season is declared if 75% of these coins outperform Bitcoin over the past 90 days. A score closer to 100 indicates a stronger altcoin season.

00:02

According to data from Arkham (ARKM), an address linked to Bitmine (starting with 0x9f84) withdrew 20,000 ETH, worth $41.07 million, from FalconX approximately seven hours ago. Withdrawals from exchanges are typically interpreted as a move to hold assets.

00:01

The 'Fear & Greed Index' from crypto data provider Alternative fell five points from yesterday to 9, keeping the market in a state of Extreme Fear. The index measures market sentiment on a scale of 0 (Extreme Fear) to 100 (Extreme Greed). It is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%).

Yesterday, February 9, 2026

23:55

South Korean crypto exchange Bithumb announced at 11:55 p.m. UTC on Feb. 9 that it has temporarily suspended deposits and withdrawals for Gravity (G) due to network issues.

23:40

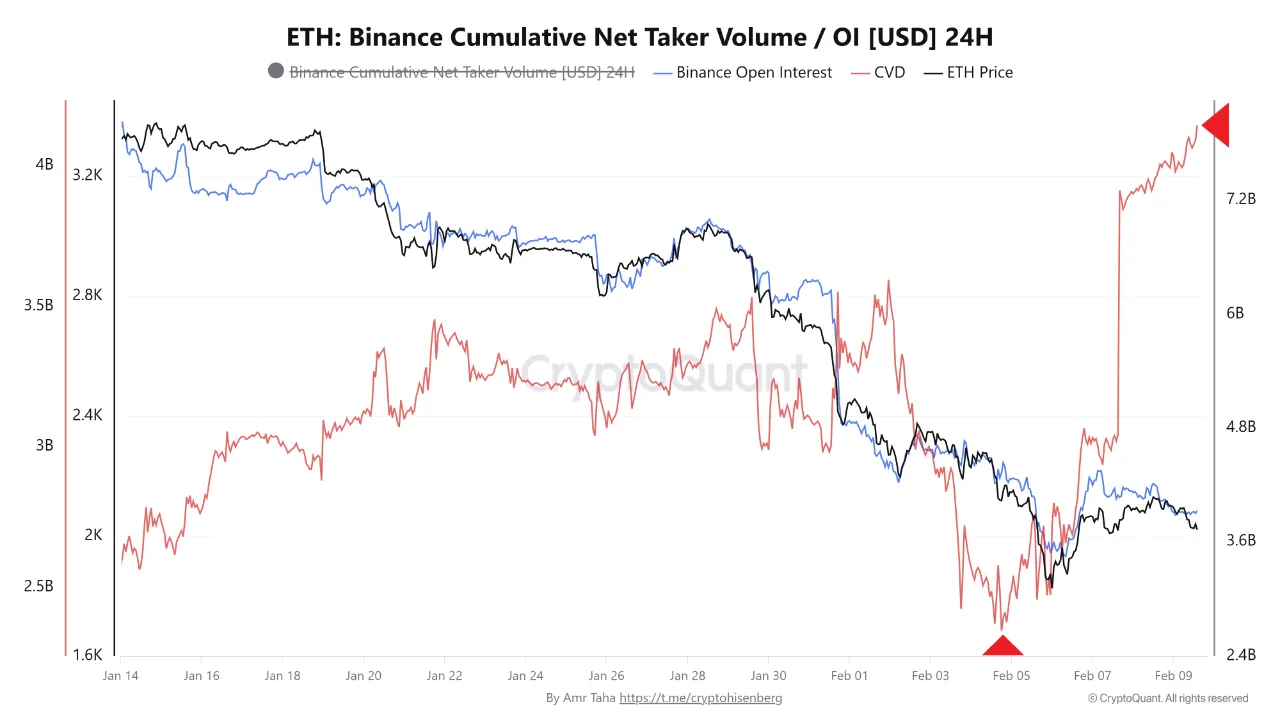

An excessive concentration of Ethereum (ETH) long positions on Binance could signal a potential price correction, according to a CryptoQuant post by analyst Amr Taha. He noted that ETH open interest on the exchange has surged from $2.4 billion on Feb. 4 to $4.15 billion, with recent data showing short positions being cleared out as new longs enter the market. Taha warned that such one-sided positioning in the derivatives market could trigger a cascade of liquidations if prices move in the opposite direction. He also pointed out that ETH's on-chain profit reached $5.8 million on Feb. 6, adding that corrections have historically occurred when this metric approached the $6 million mark.

23:30

A U.S. crypto market structure bill, known as the CLARITY Act, could pass within months, former House Financial Services Committee Chairman Patrick McHenry said in an interview with CoinDesk. He stated that he believes the final version of the bill could receive a presidential signature by the end of May. McHenry added that U.S. President Donald Trump has made this legislation a personal priority following the passage of the stablecoin regulation act (GENIUS). "DeFi is fundamental to the efficiency and transparency of cryptocurrency and cannot be excluded from the bill," he emphasized. Key points of contention in the legislation include whether to prohibit interest payments on stablecoins, the scope of DeFi inclusion, the classification of cryptocurrencies as commodities or securities, and ethics rules for public officials. The Democratic Party is advocating for stronger regulations, citing consumer harm and ethical issues, while the Republican Party and the White House are discussing a compromise.

22:26

The Ethereum Foundation has announced its sponsorship of the whitehat team Security Alliance (SEAL) to counter drain and social engineering attacks. Through its '1Ts' initiative, the foundation will support security engineers who will collaborate with the SEAL team to track and neutralize threats targeting Ethereum users. SEAL also plans to expand this collaborative model to other blockchain ecosystems.

21:58

The current sell-off in Bitcoin is being driven by early investors, leading to a changing of the guard in the market, said Bitwise Chief Investment Officer Matt Hougan in an interview with Bloomberg TV. He explained that while Bitcoin was previously held mainly by retail investors, the recent net buyers are financial advisors, family offices, and institutions, who are mostly long-term investors. According to Hougan, retail investors are currently selling faster than institutions are buying, a situation that institutions view as an opportunity. He also noted that many of the original investors remain believers in Bitcoin, viewing the market in four-year cycles and simply wanting to realize some profits while largely staying invested.

21:37

Whale Alert reported that 250 million USDC has been minted at the USDC Treasury.

21:35

Cryptocurrency exchange Backpack is seeking to raise new investment funds at a targeted valuation of $1 billion, Axios reported exclusively. Axios noted that the exchange, founded by former FTX personnel, is growing rapidly by emphasizing regulatory compliance and transparency. The funds raised are expected to be used for global market expansion and infrastructure upgrades. Backpack recently disclosed its Token Generation Event (TGE) plan and tokenomics, announcing that it will unlock 25% of the total supply at the time of the TGE. This allocation will be distributed with 24% going to point holders and 1% to NFT holders.